Investing Property auctions are one of the most exciting—and perhaps lucrative—real estate investing options. Auctions can provide a multitude of options, whether you’re trying to buy your first house, diversify your financial portfolio, or find a fixer-upper with amazing potential. Everything you need to know about property auctions, including techniques, insider information, and the crucial role these events play in places like Liverpool, UK, will be covered in detail in this guide.

What Are Auctions for Real Estate?

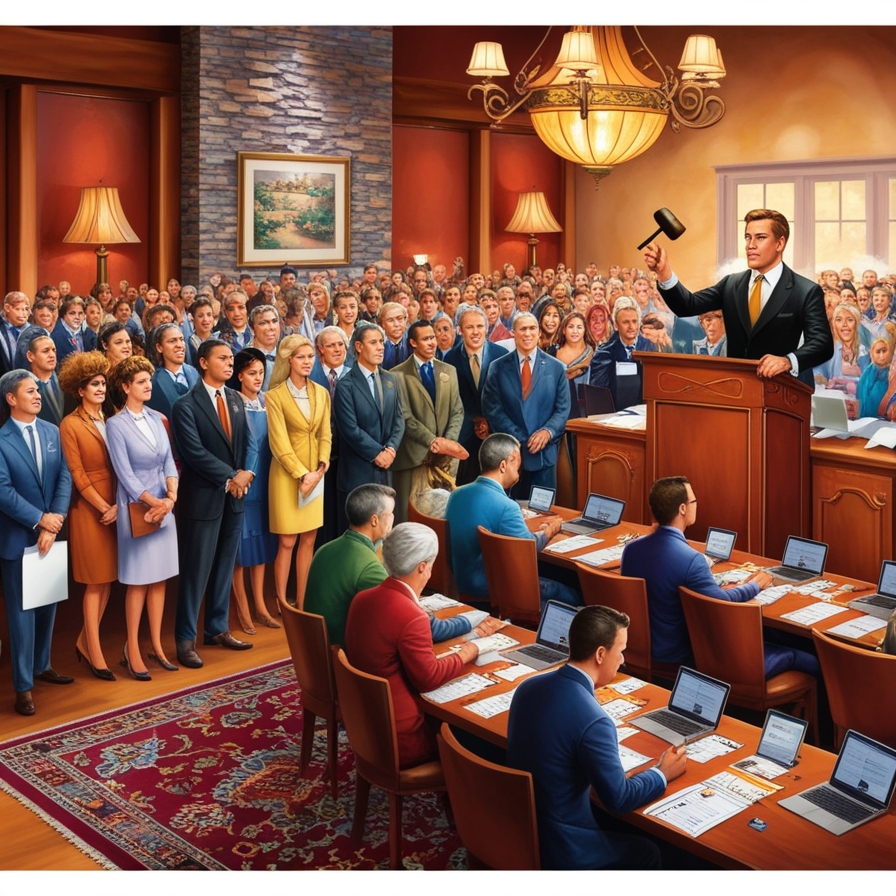

At public sales events called property auctions, the highest bidder wins the property. They can take place online, in person, or in a combination of modes. Auctions are frequently used by sellers—typically banks, real estate firms, or private citizens—to speed up sales, frequently for residences that require a speedy turnaround or repossessed properties. Auctions give buyers the chance to buy real estate at affordable costs. Due diligence is necessary for the process, though, because homes are sold “as-is,” meaning there isn’t much opportunity for discussion once the hammer falls.

Why Take a Look at Liverpool, UK Real Estate Auctions?

Liverpool is a popular destination for both first-time buyers and astute investors due to its vibrant real estate market. The attraction of property auctions in Liverpool, UK, is increased by the city’s distinctive fusion of cultural legacy, expanding infrastructure, and a flourishing rental market. Liverpool real estate usually offers a variety of options to fit different budgets, including modern apartments, historic townhouses, and even commercial premises. Liverpool also attracts investors looking for high yields due to its affordability when compared to other major UK cities.

Property Auction Types

Finding chances that fit your objectives requires an understanding of the different kinds of property auctions:

1. Conventional Auctions

These happen online or in a real auction house. The bidding process moves quickly, and it is frequently finished in 28 days.

2. The Modern Auction Method (MMOA)

Buyers can use this strategy to place online bids for a predetermined amount of time. Because it frequently has a lengthier completion time than typical auctions, it appeals to buyers who need mortgage approval.

3. Auctions for Repossession

Although repossessed houses frequently have appealing initial bids, further investigation is necessary because of possible structural or legal problems.

How to Get Ready for an Auction of Real Estate

It takes preparation, not luck, to win in real estate auctions. To increase your chances of landing a fantastic deal, take these actions:

Examine the auction catalog

Property catalogs are released by auction houses weeks in advance. Examine the listings carefully, focusing on properties in Liverpool or the area of your choice. Seek out houses with promise, but keep an eye out for any warning signs, such as structural issues or unpaid taxes.

2. Take a Look at the Property

Arrange a visit so you may see the property for yourself. Employ a reputable surveyor or agent to evaluate the property on your behalf if you are unable to go.

3. Organize Your Finances

Prior to bidding, make sure your finances are in order. Generally, an auction requires a 10% deposit on the day of sale, with the remaining amount due within 28 days. If you are interested in properties in Liverpool, speak with a local mortgage advisor who is knowledgeable about the lending environment in the area.

4. Establish a Maximum Budget

Establish a maximum bid and adhere to it. Because auctions can be emotionally charged and it is easy to get carried away, a clear budget guarantees that you don’t overspend.

The Procedure for Bidding

Arrive early on the day of the auction and become acquainted with the procedure. Make sure your internet connection is steady if you plan to bid online. With confidence and strategy, begin bidding. Refrain from placing your highest bid too soon as this could cause the price to increase needlessly. Keep in mind that bidding wars might be fierce, so remain calm and concentrate on your predetermined limit.

Hidden Costs to Watch Out For

The following are some hidden costs to be aware of when purchasing a property at auction:

- Buyer’s Premium:A fee paid to the auction house, typically a portion of the sale price;

- Survey Fees: If you have carried out a survey, this cost is non-refundable regardless of the outcome of the auction;

- Legal Fees: Ask a lawyer to examine the property’s legal pack prior to bidding;

- Renovation Costs: Many auction properties need repairs or upgrades, so account for these in your budget.

The Role of Property Auctions

in the Overall Financial Picture At Finance Hub, we view real estate auctions as crucial events in a larger wealth-building plan rather than merely transactions. Investing in real estate can help you diversify your holdings, protect against inflation, and earn passive income from rents. You can reduce risks and increase profits by collaborating with professionals who are knowledgeable about the financial environment, such as tax consultants and mortgage advisors. Finance Hub gives you the resources you need to make better, more educated decisions, regardless of your level of experience with auctions.

Typical Errors to Avoid at Real Estate Auctions

Costly errors can be made by even experienced bids. Steer clear of these pitfalls:

1. Ignoring Legal Packs

Important information such as covenants, lease conditions, and possible disputes are included in a property’s legal pack. Always go over it carefully.

2. Failure to Exercise Due Diligence

Bidding on a property without first inspecting it or doing surveys can result in costly surprises down the road.

3. Excessive bidding

Emotional bidding might reduce your profit margins and raise your expenses. Don’t go over your budget!

Steps to Take After an Auction

The actual job starts when the bid is won. What to do next is as follows:

- Pay the Deposit: Have money on hand because a 10% deposit is needed right away.

- Hire Your Solicitor: They will take care of the ownership transfer’s legal requirements.

- Plan Renovations: Employ trustworthy contractors to begin work as soon as possible if the house has to be upgraded.

Plan for Resale or Rentals: As an investor, decide if you want to flip the property for a profit or rent it out.

Liverpool’s Unique Position in the Auction Scene

Liverpool is a great place to invest in real estate because of its burgeoning economy, growing student body, and influx of young professionals. While suburbs like Allerton and Wooltonoffer family-friendly communities with strong rental demand, areas like L1 and L2 offer closeness to the city core. Liverpool is a favorite with auction purchasers because of its dedication to revitalization initiatives like the Knowledge Quarter and waterfront development, which provide long-term growth potential.

In conclusion

If you approach property auctions carefully and preparedly, they can lead to profitable opportunities. From low entry costs to high rental yields, Liverpool, UK’s thriving real estate market offers special benefits to investors. You will be in a good position to make wise, calculated judgments if you adhere to this instructions, keep yourself updated, and consult with financial professionals like Finance Hub. Are you prepared to investigate your next auction? The gavel is ringing.

Leave a Reply