Generative AI is rapidly revolutionizing the insurance industry, offering innovative solutions to streamline operations, enhance risk assessment, and improve customer experiences. As industry leaders face increasing competition and rising customer expectations, generative AI provides a powerful tool to drive efficiency and optimize business processes. From automating claims processing and fraud detection to personalizing policy offerings, this technology enables insurers to respond swiftly to market changes while reducing operational costs.

By leveraging advanced data analytics and machine learning models, generative AI can predict losses with greater accuracy, helping insurers offer more competitive premiums and mitigate potential. Furthermore, its ability to generate dynamic insights allows insurers to develop customized strategies, improving decision-making across underwriting , pricing, and customer service.

As the insurance landscape evolves, industry leaders who harness the full potential of generative AI will not only gain a competitive edge but also shape the future of insurance with smarter, more resilient business models. This article explores critical insights on how generative AI is transforming insurance and why it is essential for staying ahead in the market.

What is Generative AI?

Generative AI is a branch of artificial intelligence that focuses on creating new content, ideas, or solutions by learning from existing data. Unlike traditional AI models that classify or predict based on input, generative AI generates new, original outputs such as text, images, music, or even code. It achieves this by using advanced algorithms, such as neural networks and deep learning, to recognize patterns and relationships within large datasets. Popular models like GPT (Generative Pre-trained Transformer) and DALL-E are examples of generative AI solutions , capable of producing human-like text or creative visuals.

This technology is revolutionizing industries by automating content creation, enhancing decision-making, and streamlining processes. In sectors like healthcare, finance, and entertainment, generative AI is used to design drugs, generate financial reports, and create media content, respectively. As it continues to evolve, generative AI promises to unlock new levels of creativity, innovation, and efficiency across various fields, driving a shift towards more adaptive and dynamic problem-solving capabilities.

How Generative AI Works in Insurance?

Generative AI in insurance operates by leveraging advanced machine learning models, such as GPT or diffusion models, to create new content, insights, or solutions that enhance various aspects of the insurance industry. Here’s how it works across different areas:

1.Customer Service & Claims Processing:

- Chatbots & Virtual Assistants : Generative AI powers intelligent chatbots and virtual assistants to handle customer inquiries, process claims, and provide instant quotes. By learning from customer data, these AI systems can answer complex questions, improving customer experience and reducing response time.

- Automated Claim Generation : AI can generate reports for claims processing by analyzing accident images, documents, and customer inputs, accelerating the process and minimizing human errors.

2.Risk Assessment & Underwriting:

- Personalized Policies : Generative AI can analyze customer data to create personalized insurance policies. By examining variables such as health records, driving habits, or financial behavior, it helps insurers offer tailored premiums and coverage.

- Risk Prediction : Generative models can simulate potential future risks by analyzing trends, historical data, and external factors, assisting underwriters in making more accurate risk assessments.

3. Fraud Detection:

- Pattern Recognition : Generative AI models identify unusual patterns in data that may signal fraudulent activity. By comparing claims against historical patterns, the AI can flag suspicious claims, reducing fraud.

- Synthetic Data Generation : AI generates synthetic data for training fraud detection systems without compromising privacy, improving the accuracy of fraud prevention models.

4. Document Management:

- Automated Document Creation : Generative AI can create policy documents, contracts, and legal papers by converting structured data into comprehensive legal texts, saving time and ensuring consistency.

- Smart Data Extraction : AI models extract relevant data from claims forms, medical records, and other documents, reducing manual labor and increasing accuracy.

5.Product Development & Innovation:

- Simulating New Products : Insurers can use generative AI to simulate the outcomes of new insurance products based on customer data and market trends. This helps test ideas in a virtual environment before launching them.

- Predictive Analytics : AI can predict shifts in customer needs and market conditions, allowing insurers to adapt and innovate faster.

Generative AI helps insurance companies optimize their operations, enhance customer experiences, and improve decision-making processes, all while reducing costs and increasing efficiency.

Key Benefits of Generative AI for Insurance Companies

Generative AI offers numerous benefits for insurance companies, helping them streamline operations, enhance customer service, and improve decision-making processes. Here are the key benefits:

1.Improved Customer Experience

- 24/7 Support : AI-powered virtual assistants provide round-the-clock customer service, handling inquiries, processing claims, and offering personalized policy recommendations.

- Faster Claims Processing : Automating claims submission, verification, and report generation reduces significantly the time to process claims, improving customer satisfaction.

2. Cost Efficiency

- Automating Routine Tasks : AI can handle repetitive administrative tasks, such as data entry, form processing, and document generation, reducing operational costs.

- Fraud Prevention : By detecting and flagging fraudulent claims early, generative AI helps insurers save millions in fraud-related losses.

3. Enhanced Risk Assessment & Underwriting

- Accurate Risk Prediction : AI models analyze vast datasets to predict risks more accurately, allowing insurers to offer customized premiums and policies based on a customer’s unique profile.

- Data-Driven Underwriting : AI speeds up the underwriting process by automating the evaluation of customer data, improving accuracy and decision-making.

4. Fraud Detection and Prevention

- Pattern Recognition : AI identifies unusual behaviors and claims patterns that signal potential fraud, helping insurers take proactive measures.

- Synthetic Data Training : AI-generated synthetic data improves fraud detection systems by training models on realistic yet anonymized datasets.

5. Faster Product Development

- Personalized Policies : AI generates tailored insurance products based on real-time customer data, ensuring policies meet individual needs and market demand.

- Scenario Simulation : Generative AI can simulate different market conditions and customer behaviors, enabling insurers to test and refine new products before launching.

6. Scalability and Flexibility

- Handling High Volume : Generative AI solutions can scale to meet demand during peak times, such as after natural disasters or economic downturns, when claim volumes rise.

- Multi-Channel Integration : AI can be integrated across multiple platforms — web, mobile, email, and chat — ensuring consistent customer experiences across all touchpoints.

7. Data-Driven Decision Making

- Real-Time Insights : AI can process vast amounts of data in real-time, providing actionable insights for faster decision-making and strategy development.

- Predictive Analytics : By analyzing trends and forecasting future risks, generative AI supports more informed, data-driven decisions.

8. Regulatory Compliance

- Automated Documentation : AI can generate accurate and compliant policy documents, contracts, and reports, ensuring regulatory adherence.

- Smart Data Management : AI solutions ensure efficient handling of customer data while maintaining compliance with privacy and security regulations like GDPR.

9. Enhanced Employee Productivity

- Task Automation : Automating routine tasks frees employees to focus on more complex, value-added activities, such as customer relationship management or strategic planning.

- Decision Support : AI assists underwriters, claims adjusters, and customer service reps with instant data analysis, improving their decision-making speed and accuracy.

These benefits make generative AI a powerful tool for insurance companies, driving both operational efficiencies and enhanced customer satisfaction.

Critical Insights for Industry Leaders

For industry leaders in the insurance sector, leveraging generative AI effectively requires strategic foresight and careful consideration of several critical insights. Here are key points to guide decision-making and implementation:

1. Embrace Data-Driven Decision Making

- Invest in Data Infrastructure : Build a robust data infrastructure to collect, manage, and analyze customer data efficiently. Ensure data is clean, comprehensive, and compliant with regulations to maximize AI effectiveness.

- Utilize Advanced Analytics : advanced analytics tools that leverage generative AI for deeper insights into customer behavior, risk assessment, and market trends.

2. Foster a Culture of Innovation

- Encourage Experimentation : Cultivate an organizational culture that encourages experimentation with generative AI applications. This may involve pilot programs or collaborations with startups to explore innovative solutions.

- Continuous Learning : Provide ongoing training and development opportunities for employees to adapt to new technologies and methodologies, ensuring they are equipped to utilize AI effectively.

3. Prioritize Customer Experience

- Enhance Personalization : Utilize generative AI to create tailored experiences for customers. Focus on hyper-personalization in product offerings, marketing, and customer interactions to enhance engagement and satisfaction.

- Proactive Customer Support : Leverage AI to anticipate customer needs and provide proactive support, improving overall customer relationships and loyalty.

4. Address Ethical and Compliance Considerations

- Develop Ethical Guidelines : Establish ethical frameworks for AI usage, focusing on transparency, fairness, and accountability. Regularly assess AI systems for bias and ensure they align with societal values.

- Ensure Regulatory Compliance : Stay updated on regulatory changes impacting AI in insurance. Develop compliance protocols to mitigate legal risks and enhance trust with customers.

5. Invest in Technology Partnerships

- Collaborate with Tech Innovators : Form strategic partnerships with technology companies and AI startups to access cutting-edge tools and expertise. This collaboration can accelerate innovation and implementation of AI solutions.

- Leverage Ecosystem Collaborations : Engage with industry consortia and innovation hubs to share knowledge, best practices, and resources, fostering collective growth and advancement in AI capabilities.

6. Focus on Change Management

- Plan for Cultural Shift : Implement a change management strategy that addresses potential resistance to AI adoption. Communicate the benefits of AI clearly to all stakeholders to facilitate smoother transitions.

- Empower Employees : Involve employees in the AI implementation process by gathering their insights and feedback. This inclusivity can enhance buy-in and increase the likelihood of successful adoption.

7. Measure and Evaluate Performance

- Establish KPIs : Develop clear key performance indicators (KPIs) to measure the success of AI initiatives. Regularly assess the impact of generative AI on operational efficiency, customer satisfaction, and financial performance.

- Iterate and Improve : Use insights gained from performance evaluations to refine and optimize AI strategies continually. Stay agile and responsive to changes in technology and market demands.

8. Prepare for Future Challenges

- Anticipate Market Disruptions : Stay vigilant about emerging trends and potential disruptions in the insurance industry. Use generative AI to model different scenarios and prepare strategic responses.

- Invest in Cybersecurity : As reliance on AI increases robust, so do cybersecurity risks. Implement cybersecurity measures to protect sensitive data and AI systems from threats.

9. Leverage AI for Sustainability

- Promote Sustainable Practices : Use generative AI to assess the environmental impact of insurance products and operations. Develop solutions that align with sustainability goals and address climate-related risks.

- Social Responsibility Initiatives : Consider how AI can support socially responsible initiatives, such as expanding coverage to underserved populations or enhancing community resilience.

10. Engage with Stakeholders

- Communicate with Customers and Regulators : Maintain open lines of communication with customers, regulators, and other stakeholders regarding AI initiatives. Transparency builds trust and fosters collaboration.

- Gather Feedback : Actively seek feedback from customers and employees to refine AI applications and ensure they meet the needs and expectations of all stakeholders.

By focusing on these critical insights, industry leaders can navigate the complexities of generative AI in the insurance sector, driving innovation and enhancing value for customers and stakeholders alike.

Ethical and regulatory considerations

The rise of generative AI brings significant ethical and regulatory considerations that organizations must navigate to ensure responsible use. One primary concern is the potential for bias in AI-generated content, which can arise from biased training data, leading to unfair or discriminatory outcomes. To mitigate this, companies must prioritize diverse and representative datasets, alongside ongoing monitoring for bias. Additionally, the transparency of AI systems is crucial; organizations should strive to make their AI models interpretable, allowing stakeholders to understand how decisions are made.

Intellectual property issues also pose challenges, particularly concerning the ownership of AI-generated content and the potential for copyright infringements. Furthermore, compliance with data protection regulations, such as GDPR, is essential to safeguard user privacy and maintain trust. As generative AI continues to evolve, organizations should proactively engage with ethical guidelines and regulatory frameworks, fostering an environment of accountability and transparency to navigate the complexities of this transformative technology.

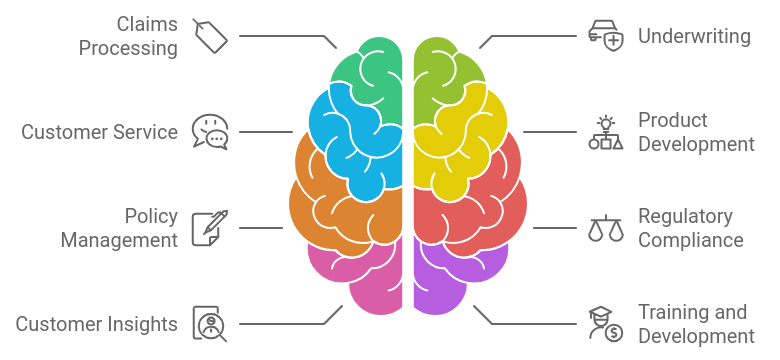

Key Areas of Application for Generative AI in Insurance

1. Underwriting and Risk Assessment

Underwriting is the backbone of insurance operations. Traditionally, it relies on structured data and actuarial models. Generative AI enhances this by:

- Creating Sophisticated Risk Models: By analyzing historical data and generating predictive insights, generative AI helps insurers assess risk at a granular level.

- Personalizing Policies: AI can generate personalized insurance products tailored to individual needs, moving away from one-size-fits-all solutions.

- Simulating Scenarios: Generative models can simulate various risk scenarios, helping underwriters make informed decisions.

Example: An AI-powered underwriting system might predict higher flood risks in specific regions due to changing weather patterns and recommend policy adjustments accordingly.

2. Claims Processing

Claims processing is often slow, manual, and prone to errors. Generative AI can streamline this by:

- Automating Documentation: AI can generate reports, fill out forms, and extract critical details from claims submissions.

- Enhancing Decision-Making: By analyzing past claims, generative AI predicts legitimate claims, expediting the approval process.

- Improving Accuracy: AI minimizes human errors in claims documentation and reduces processing times.

Example: Chatbots powered by generative AI can assist claimants in real-time, guiding them through the submission process while verifying document authenticity.

3. Fraud Detection

Insurance fraud costs billions annually. Generative AI can help by:

- Identifying Anomalies: AI models generate predictive insights to flag suspicious claims patterns.

- Simulating Fraudulent Scenarios: Generative AI can create scenarios based on past fraud cases, training systems to detect potential fraud proactively.

- Integrating Real-Time Analysis: AI monitors ongoing transactions, identifying irregularities as they occur.

Example: AI systems might detect an unusually high frequency of claims from a single region, prompting further investigation.

4. Customer Experience

Generative AI transforms customer interactions by:

- Enhancing Communication: AI can generate human-like responses in real-time, offering personalized assistance via chatbots or virtual agents.

- Providing Tailored Recommendations: By analyzing user behavior, AI suggests products and services that meet specific needs.

- Simplifying Complex Information: Generative AI translates intricate policy terms into simpler language, improving customer comprehension.

Example: Virtual agents can walk a policyholder through coverage options in a conversational tone, making complex decisions easier.

5. Product Innovation

Generative AI enables insurers to create innovative products by:

- Developing Usage-Based Insurance (UBI): AI neural driving behavior for auto insurance or lifestyle habits for health coverage, offering dynamic pricing.

- Exploring New Markets: AI-generated insights reveal underserved markets, aiding in product development.

- Predicting Trends: Generative AI identifies emerging risks, such as cybersecurity threats, guiding product innovation.

Example: An insurer could launch a cyber insurance product specifically for small businesses, based on AI-predicted vulnerabilities.

Challenges and Risks of Generative AI

Despite its transformative potential, generative AI is not without challenges:

1. Data Privacy and Security

- Generative AI requires vast amounts of data, raising concerns about data privacy and compliance with regulations like GDPR or HIPAA.

- The risk of data breaches increases with centralized AI systems.

2. Bias in AI Models

- AI systems may perpetuate or even amplify existing biases present in training data, leading to unfair outcomes.

- Ensuring diversity and inclusivity in AI algorithms is critical.

3. Regulatory and Ethical Concerns

- The regulatory landscape for AI in insurance is still evolving, creating uncertainty for adoption.

- Ethical dilemmas, such as transparency and accountability, need addressing.

4. High Implementation Costs

- Building, training, and maintaining generative AI systems require significant investment.

- Smaller insurers might struggle to compete with larger players due to resource constraints.

5. Over-Reliance on AI

- While AI can augment human decision-making, over-reliance might lead to unintended consequences if systems fail or make incorrect predictions.

Strategic Approaches for Industry Leaders

To harness the full potential of generative AI, insurance leaders must adopt strategic approaches:

1. Invest in Data Quality

- High-quality, diverse data ensures better AI model performance.

- Leaders should prioritize robust data governance frameworks.

2. Foster Collaboration

- Collaborate with technology providers, startups, and academic institutions to stay ahead of innovations.

- Cross-industry partnerships can drive new insights and solutions.

3. Focus on Explainability

- Insurers must ensure AI systems are transparent and explainable to build trust among customers and regulators.

- Implementing AI governance policies is essential.

4. Emphasize Employee Training

- Equip teams with the skills to work alongside AI tools effectively.

- Continuous education on AI ethics and applications is vital.

5. Adopt a Phased Approach

- Begin with pilot projects to test generative AI applications in specific areas.

- Scale successful implementations across the organization incrementally.

Use Cases of Generative AI in the Insurance Sector

Generative AI has a variety of impactful use cases in the insurance sector, enhancing efficiency, accuracy, and customer satisfaction. Here are some notable applications:

1. Claims Processing

- Automated Claim Generation : Generative AI can create initial claims reports based on customer input and supporting documents, reducing the time required for claims submission and processing.

- Fraud Detection : AI patterns in claims data to identify potentially fraudulent submissions, flagging them for further investigation.

2. Underwriting

- Risk Assessment Models : Generative AI helps create sophisticated risk assessment models that analyze vast amounts of data to determine risk profiles, allowing for more accurate pricing of insurance policies.

- Personalized Policy Creation : AI generates customized insurance policies based on individual customer data, ensuring tailored coverage that meets specific needs.

3.Customer Service

- Intelligent Chatbots : AI-powered chatbots provide instant responses to customer inquiries, guiding users through policy details, claims processes, and general insurance information.

- Virtual Assistants : These AI systems assist customers in real-time by answering questions and helping them navigate the insurance process.

4. Product Development

- Scenario Simulation : Generative AI can simulate various market conditions and customer behaviors to help insurers develop new products and refine existing ones.

- Market Trend Analysis : AI compilation trends and customer feedback to generate insights on potential new insurance offerings or enhancements to existing products.

5. Policy Management

- Document Generation : AI automates the creation of policy documents, contracts, and renewal notices, ensuring accuracy and compliance with regulations.

- Smart Data Extraction : Generative AI can extract relevant information from documents and forms, streamlining policy management and reducing manual labor.

6. Regulatory Compliance

- Automated Reporting : AI systems generate reports needed for regulatory compliance, ensuring that insurers adhere to legal requirements and reduce the risk of penalties.

- Risk Monitoring : AI continuously monitors regulatory changes and assesses their impact on the company’s policies and practices.

7. Customer Insights

- Predictive Analytics : Generative AI orchestrates customer data to predict behaviors and preferences, enabling insurers to tailor marketing efforts and improve customer engagement.

- Sentiment Analysis : AI tools assess customer feedback and sentiment on social media and review platforms, providing insights for service improvement.

8. Training and Development

- AI-Powered Training Simulations : Generative AI creates realistic training scenarios for insurance agents and claims adjusters, enhancing their skills and preparedness.

- Knowledge Management : AI systems generate knowledge bases that evolve over time, ensuring employees have access to the most current information and best practices.

9. Telematics and Risk Mitigation

- Real-Time Data Analysis : For auto insurers, generative AI processes telematics data to assess driving behavior, offering insights for better risk assessment and pricing.

- Personalized Risk Mitigation Strategies : AI generates tailored recommendations for risk reduction based on individual customer profiles and behaviors.

10. Health Insurance

- Personalized Health Plans : Generative AI creates customized health insurance plans based on individual health data, lifestyle choices, and risk factors.

- Claims Verification : AI verifies claims against patient data and treatment records, ensuring accuracy and reducing fraud.

These use cases highlight the transformative potential of generative AI in the insurance sector, driving innovation, efficiency, and improved customer experiences.

Applications of Generative AI in Insurance

Generative AI is transforming the insurance industry by enhancing processes, improving customer experiences, and driving innovation. Here are some key applications of generative AI in insurance:

1. Automated Claims Processing

- Intelligent Document Processing : Generative AI can automate the extraction of information from claims documents, speeding up the claims process and reducing human error.

- Claims Prediction and Management : AI models predict claims outcomes based on historical data, allowing insurers to manage reserves and anticipate potential losses.

2. Personalized Underwriting

- Dynamic Risk Assessment : Generative AI aggregates vast amounts of data to create detailed risk profiles, enabling more accurate underwriting decisions and personalized policy offerings.

- Automated Policy Generation : AI can generate tailored insurance policies based on individual risk factors and customer needs, coverage is both relevant and ensuring appropriate.

3. Enhanced Customer Service

- AI-Powered Chatbots : Generative AI chatbots provide real-time assistance to customers, answering queries, guiding them through policy options, and facilitating claims submissions.

- Virtual Customer Assistants : These AI systems can proactively engage customers, offering personalized recommendations and reminders about policy renewals or updates.

4. Fraud Detection and Prevention

- Anomaly Detection Models : Generative AI nested claims data to identify patterns indicative of fraud, flagging suspicious claims for further investigation.

- Behavioral Analysis : By understanding typical customer behavior, AI can detect deviations that may suggest fraudulent activity.

5. Product Development

- Market Simulation : AI can simulate market conditions and customer behavior, helping insurers design new products that meet emerging customer needs and market demands.

- Feedback Analysis : Generative AI processes customer feedback and market trends to refine existing products and develop new insurance offerings.

6. Risk Management

- Predictive Analytics for Risk Assessment : AI models predict potential risks by analyzing various factors, such as economic indicators, weather patterns, and historical data, allowing insurers to adjust policies and pricing accordingly.

- Scenario Planning : Generative AI can simulate various scenarios, such as natural disasters or economic downturns, enabling insurers to prepare for and mitigate risks.

7. Regulatory Compliance

- Automated Reporting Tools : Generative AI helps insurers generate compliance reports, ensuring they meet regulatory requirements efficiently and accurately.

- Risk Monitoring : AI systems continuously monitor regulatory changes and assess their impact on company policies and practices.

8. Marketing and Customer Insights

- Targeted Marketing Campaigns : Generative AI compiled customer data to create targeted marketing strategies, optimizing outreach efforts based on individual preferences and behaviors.

- Sentiment Analysis : AI tools assess customer sentiment from social media and reviews, providing insights that can shape marketing strategies and product development.

9. Training and Development

- Personalized Training Programs : Generative AI can create customized training modules for employees, ensuring they are well-versed in the latest technologies and best practices.

- Knowledge Management : AI systems can curate and generate knowledge bases, ensuring employees have access to up-to-date information and resources.

10. Telematics and IoT Integration

- Real-Time Data Collection : For auto insurers, generative AI neural data from telematics devices to assess driving behavior and adjust policies accordingly.

- Personalized Insurance Plans : AI uses IoT data to create customized insurance products based on individual customer habits, such as home security systems for homeowners insurance.

11. Health Insurance Applications

- Personalized Health Plans : Generative AI helps insurers create tailored health insurance plans based on individual health data and risk factors.

- Claims Verification : AI verifies claims against treatment records, ensuring accuracy and preventing fraud.

12. Customer Retention Strategies

- Churn Prediction Models : AI aggregate customer behavior to identify potential churn risks, enabling proactive retention strategies.

- Loyalty Programs: Generative AI can create and manage personalized loyalty programs that reward customers for continued engagement with the insurer.

13. Investment Strategies

- Portfolio Management: Generative AI assists insurers in optimizing investment strategies by analyzing market trends and predicting asset performance.

- Risk Assessment in Investments: AI models assess risks associated with various investment options, helping insurers make informed decisions.

These applications demonstrate how generative AI is reshaping the insurance landscape, leading to more efficient processes, improved customer interactions, and innovative product offerings. As technology continues to evolve, the potential for generative AI in insurance will only expand, driving further transformation in the industry.

Challenges in Implementing Generative AI

Implementing generative AI comes with several challenges that organizations must address to fully harness its potential. One of the primary hurdles is the need for vast amounts of high-quality data, as generative AI models rely heavily on training data to produce accurate and relevant outputs. Inadequate or biased data can lead to flavored models, resulting in incorrect predictions or unintended outcomes. Additionally, the computational power required to train and deploy these models is significant, making it a costly endeavor, especially for smaller businesses.

Another key challenge is the complexity of integrating generative AI into existing systems, as it often requires specialized skills in AI development, machine learning, and data science. Furthermore, there are concerns regarding the use of ethical AI-generated content, such as ensuring transparency , avoiding misinformation, and preventing intellectual property violations. Regulatory compliance and data privacy also pose challenges, as organizations must navigate evolving laws to ensure responsible AI usage. Overcoming these obstacles requires a strategic approach, combining technological investment, skilled expertise, and ethical considerations for successful generative AI implementation.

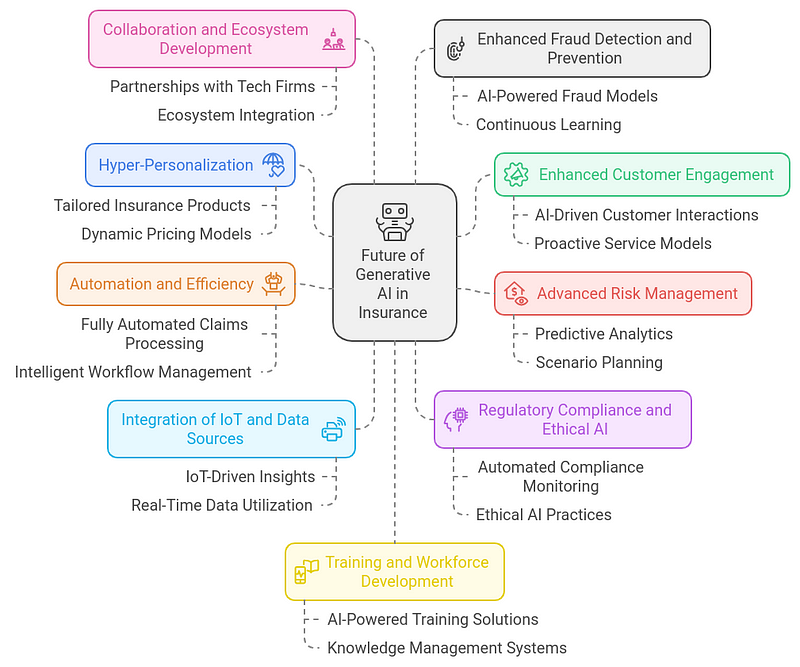

Future of Generative AI in Insurance

The future of generative AI in the insurance sector looks promising, with advancements poised to revolutionize operations, customer engagement, and risk management. Here are some key trends and developments expected to shape this future:

1. Hyper-Personalization

- Tailored Insurance Products : Generative AI will enable insurers to create highly personalized insurance policies based on comprehensive data analysis, including customer behavior, preferences, and individual risk profiles.

- Dynamic Pricing Models : AI will facilitate real-time adjustments to premiums based on changing risk factors, allowing for more competitive and customer-centric pricing.

2. Enhanced Customer Engagement

- AI-Driven Customer Interactions : Expect smarter chatbots and virtual assistants capable of handling complex queries, providing personalized recommendations, and engaging customers through various channels.

- Proactive Service Models : AI will allow insurers to anticipate customer needs and deliver proactive service, such as alerts for policy renewals, coverage gaps, or potential claims.

3. Advanced Risk Management

- Predictive Analytics : The use of generative AI will expand to develop more sophisticated predictive models that can forecast risks with higher accuracy, helping insurers better assess and mitigate potential losses.

- Scenario Planning : AI will facilitate scenario modeling for catastrophic events, allowing insurers to prepare for and respond to emerging risks in real-time.

4. Automation and Efficiency

- Fully Automated Claims Processing : Future developments will lead to completely automated claims processes, where AI handles everything from initial claims intake to final settlement, significantly reducing processing times.

- Intelligent Workflow Management : AI will streamline internal workflows, improving operational efficiency and allowing staff to focus on higher-value tasks, such as customer relationships and strategic planning.

5. Integration of IoT and Data Sources

- IoT-Driven Insights : As the Internet of Things (IoT) expands, generative AI will integrate data from connected devices (eg, telematics in vehicles, smart home devices) to enhance risk assessment and provide personalized coverage options.

- Real-Time Data Utilization : Insurers will leverage real-time data analytics to inform decision-making, optimize underwriting processes, and enhance claims assessments.

6. Regulatory Compliance and Ethical AI

- Automated Compliance Monitoring : Generative AI will assist in continuously monitoring regulatory changes and ensuring compliance through automated reporting and documentation generation.

- Ethical AI Practices : As concerns about bias and fairness in AI grow, the insurance industry will prioritize the development of ethical AI frameworks to ensure transparency, accountability, and fairness in AI-driven processes.

7. Collaboration and Ecosystem Development

- Partnerships with Tech Firms : Insurers will increasingly collaborate with technology providers and AI startups to leverage cutting-edge generative AI solutions, fostering innovation and enhancing service offerings.

- Ecosystem Integration : The integration of generative AI into broader financial ecosystems will enable insurers to offer holistic services, combining insurance with financial planning and risk management.

8. Enhanced Fraud Detection and Prevention

- AI-Powered Fraud Models : Future generative AI solutions will employ advanced algorithms to detect and prevent fraudulent activities utilizing historical data and real-time analytics to identify suspicious patterns quickly.

- Continuous Learning : AI systems will continually learn from new data, improving their accuracy in detecting fraudulent claims and adapting to evolving tactics used by fraudsters.

9. Training and Workforce Development

- AI-Powered Training Solutions : Generative AI will provide customized training programs for insurance professionals, ensuring they are well-equipped to leverage new technologies and provide superior customer service.

- Knowledge Management Systems : AI will enhance knowledge sharing within organizations, enabling employees to access and utilize the latest insights and best practices efficiently.

10. Sustainability and Social Responsibility

- Risk Assessment for Climate Change : Generative AI will play a crucial role in assessing risks associated with climate change, enabling insurers to create more sustainable insurance products and contribute to environmental responsibility.

- Socially Responsible Insurance Solutions : AI will help insurers develop products that address social challenges, such as affordable healthcare, accessible auto insurance, and coverage for underserved communities.

The future of generative AI in insurance will drive significant advancements, making the industry more efficient, customer-centric, and resilient in the face of emerging challenges. By embracing these technologies, insurers can transform their operations and better serve their customers in a rapidly changing landscape.

Conclusion

Generative AI is poised to become a cornerstone of the insurance industry, driving innovation, efficiency, and enhanced decision-making. For industry leaders, embracing this technology is not just a competitive advantage but a necessity in navigating an increasingly complex and fast-evolving market By automating processes, improving risk assessment accuracy, and delivering personalized customer experiences, generative AI empowers insurers to meet rising consumer expectations and manage risk more effectively.

As the technology continues to mature, its potential to reshape traditional insurance models will only grow, offering new opportunities to optimize underwriting, claims management, and fraud detection. However, to fully unlock these benefits, industry leaders must invest in the right infrastructure, foster a culture of innovation, and ensure that ethical and regulatory considerations are met.

In doing so, they can leverage generative AI not only to streamline operations but also to build more adaptive and forward-thinking insurance solutions. Those who act swiftly to integrate generative AI will be well-positioned to lead the insurance sector into the future.

Leave a Reply