In today’s rapidly evolving regulatory environment, businesses face increasing pressure to comply with a wide array of local and global regulations. Non-compliance can lead to substantial penalties, reputational damage, and operational disruptions. As a result, conducting a compliance risk assessment has become a crucial practice for businesses seeking to identify and mitigate potential risks associated with regulatory compliance.

What is Compliance Risk Assessment?

A compliance risk assessment is a systematic process of identifying, evaluating, and prioritizing potential risks that could prevent a company from adhering to laws, regulations, and internal policies. This assessment helps businesses understand the compliance landscape they are operating in and allows them to implement proactive measures to reduce the chances of non-compliance.

The goal is to identify not only the current risks but also those that could arise in the future due to changing regulations or business operations. Through effective assessment and continuous monitoring, organizations can ensure they are always in line with the latest legal and regulatory requirements.

Why is Compliance Risk Assessment Important?

-

Early Detection of Risks: By conducting a comprehensive risk assessment, businesses can identify potential compliance risks before they escalate into significant problems.

-

Avoiding Legal and Financial Penalties: Non-compliance with industry regulations can result in heavy fines and penalties. A proper assessment allows organizations to pinpoint and address risks, avoiding these costly consequences.

-

Maintaining Reputation: A company that consistently fails to comply with regulations risks damaging its reputation. On the other hand, ensuring compliance fosters trust and strengthens relationships with clients, partners, and stakeholders.

-

Optimizing Operational Efficiency: A compliance risk assessment can help organizations streamline their processes and make them more efficient. By aligning processes with regulatory requirements, businesses can eliminate unnecessary steps, reduce duplication, and focus on high-impact activities.

-

Facilitating Strategic Planning: By understanding compliance risks, organizations can better plan their growth strategies and make informed decisions about expansion, mergers, and new business ventures.

How to Conduct a Compliance Risk Assessment?

-

Identify Relevant Regulations: The first step in a compliance risk assessment is identifying all relevant laws and regulations that apply to the business, whether local, national, or international. These could cover areas like data protection, financial reporting, environmental laws, and industry-specific regulations.

-

Assess Compliance Risks: After identifying the regulations, the next step is evaluating potential risks. This can include the risk of employee misconduct, failure to meet reporting deadlines, or inadequate data protection measures. The key is to consider both the likelihood and impact of each risk.

-

Evaluate Internal Controls: A critical part of the assessment process involves reviewing the internal controls that are in place to manage compliance risks. This includes examining policies, procedures, and systems that help ensure compliance.

-

Prioritize Risks: Not all compliance risks are equal. Some may have a greater impact on the organization, while others may be less significant. Businesses need to prioritize risks based on their severity and likelihood.

-

Implement Mitigation Measures: Once risks are identified and prioritized, businesses should implement controls and mitigation strategies to reduce or eliminate those risks. This could involve updating policies, improving training, or investing in technology solutions that help streamline compliance efforts.

-

Ongoing Monitoring: Compliance is an ongoing process. Businesses should continuously monitor their risk landscape and adjust their strategies as regulations change or new risks emerge.

Streamlining Compliance with MonitorMate

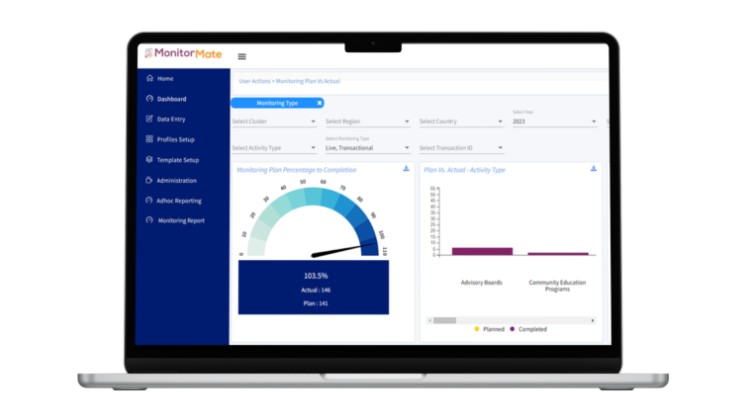

For businesses looking for a reliable solution to manage their compliance risk assessment and ongoing monitoring, MonitorMate by Cresen Solutions offers an innovative tool to simplify the process. MonitorMate is designed to help organizations streamline their compliance efforts and ensure they are always in alignment with the latest regulations.

With MonitorMate, businesses can automate the monitoring of compliance risks, enabling proactive identification and mitigation of potential risks. The platform provides real-time insights into regulatory changes and ensures that all necessary actions are taken in response to emerging compliance issues.

Incorporating a tool like MonitorMate into your compliance risk assessment process can provide immense value, saving time and resources while enhancing overall efficiency.

Conclusion

A compliance risk assessment is an essential practice for businesses aiming to stay ahead of regulatory changes and mitigate the risks of non-compliance. By regularly evaluating potential risks and implementing robust internal controls, organizations can protect themselves from penalties, legal issues, and reputational damage.

With solutions like MonitorMate, businesses can enhance their ability to manage compliance risks, automate monitoring processes, and maintain continuous compliance, ensuring they remain agile and resilient in an increasingly complex regulatory environment.

Leave a Reply