SharkShop Credit Score Programs: The Key to Better Financial Health

Welcome to the future of financial wellness! If you’ve ever felt overwhelmed by your credit score or uncertain about how it impacts your financial journey, you’re not alone. Enter SharkShop.biz Credit Score Programs—the game-changing tools designed to empower you on your path to better financial health.

Whether you’re looking to secure a loan, buy a new home, or simply boost your confidence in managing finances, understanding and improving your credit score is essential. In this post, we’ll dive into how SharkShop’s innovative programs can help demystify the world of credit scores and put you in control of your financial destiny. Get ready to unlock doors and pave the way for a brighter financial future!

Introduction to the Importance of Credit Scores

Credit scores are more than just numbers; they hold the key to your financial future. Whether you’re looking to buy a home, secure a loan, or even land that dream job, your credit score plays a crucial role in making it happen. Yet many people overlook its significance until it’s too late.

Enter SharkShop.biz an innovative platform designed to demystify credit scores and empower you with the tools needed for better financial health. If you’ve ever wondered how to boost your score or understand it better, SharkShop might just be the solution you’ve been searching for. Let’s dive deep into what this program offers and how it can transform your financial journey!

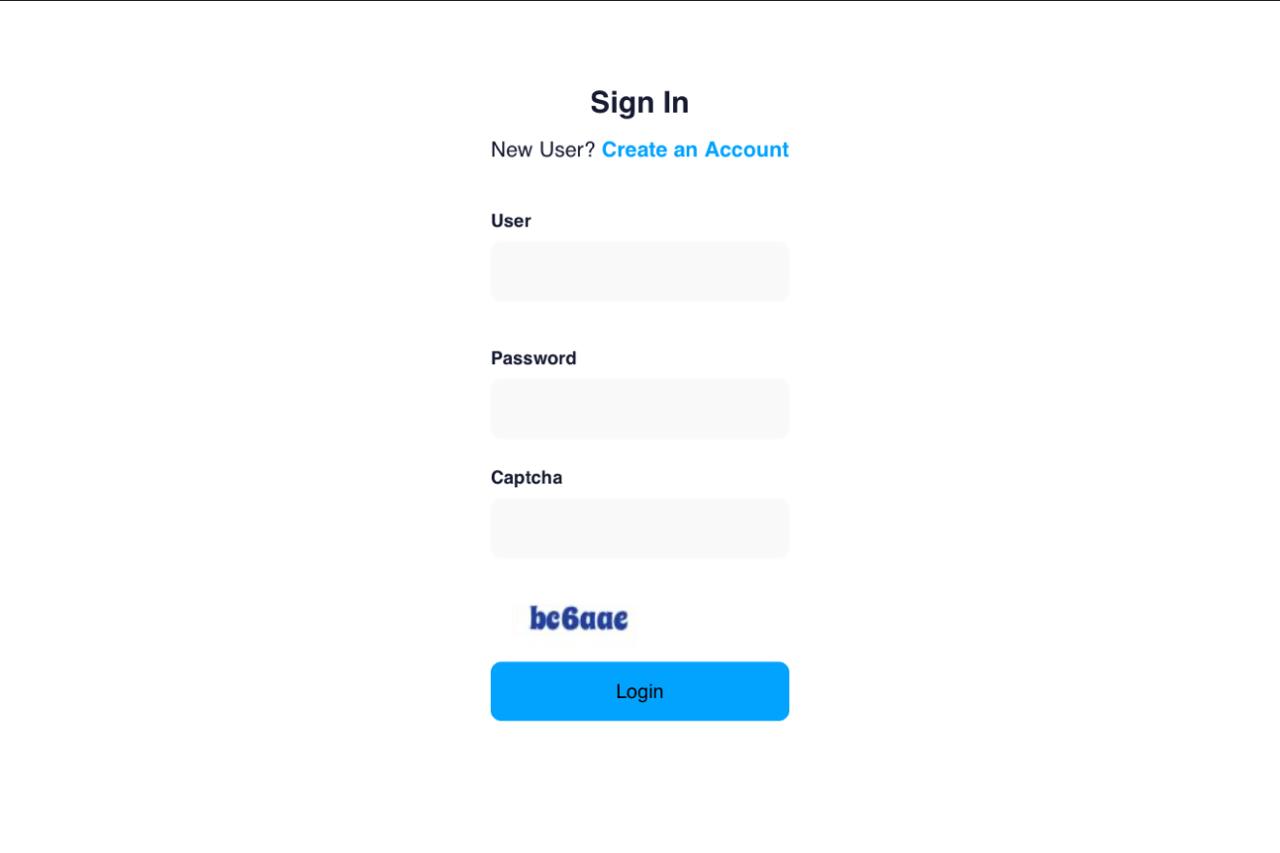

A Screenshot of Sharkshop (Sharkshop.biz) login page

What is the SharkShop Credit Score Program?

The SharkShop Credit Score Program is an innovative tool designed to empower individuals in managing their financial health. It offers a comprehensive overview of your credit score, making it easy to understand where you stand financially.

With user-friendly features, the program simplifies complex credit information into digestible insights. You can quickly access your current score and learn about the key factors influencing it.

SharkShop also goes beyond just providing numbers. The platform includes personalized recommendations tailored to help improve your creditworthiness over time. This means actionable steps that users can take immediately.

In addition, members benefit from ongoing educational resources that demystify the often confusing world of credit scores. These tools make navigating personal finance less daunting and more accessible for everyone, regardless of their starting point.

Benefits of Using SharkShop for Your Credit Score

Using SharkShop for your credit score offers numerous advantages. First, it provides a comprehensive view of your financial health. You can track changes in real-time and monitor factors that impact your score.

The user-friendly interface makes navigation simple, even for beginners. With clear visuals and easy-to-understand metrics, you’ll feel empowered to take control of your finances.

SharkShop also offers personalized tips tailored to your unique situation. These insights help you understand what actions will benefit you most.

Another notable feature is the alerts system. Stay informed about any significant changes to your credit report or potential fraud attempts, ensuring you’re always one step ahead.

Moreover, SharkShop connects you with resources like educational articles and webinars designed to deepen your understanding of credit management. This knowledge base enhances not just awareness but encourages proactive decision-making regarding finances.

Understanding and Improving Your Credit Score with SharkShop’s Tools and Resources

SharkShop login offers a suite of tools designed to help you understand your credit score better. Their user-friendly dashboard provides easy access to your current score, along with detailed explanations of what factors influence it.

With personalized insights, users can identify areas for improvement. This means knowing which debts are affecting your score negatively and how to prioritize payments effectively.

SharkShop also includes educational resources—articles and webinars—that break down complex credit concepts into digestible information. You’ll learn about the impact of timely bill payments and maintaining low credit card balances.

Additionally, their goal-setting features allow you to set achievable milestones for enhancing your financial health. Tracking progress becomes straightforward as you receive alerts on significant changes in your score or upcoming payment deadlines.

Empowering yourself with SharkShop’s resources sets the stage for lasting financial well-being.

Real Life Success Stories: How SharkShop Helped People Improve Their Credit Scores

Jessica, a single mom from Texas, struggled with her credit score due to unpaid medical bills. After joining SharkShop, she accessed personalized tools that outlined actionable steps for improvement. Within six months, her score jumped by over 100 points.

Then there’s Marcus from California. He was overwhelmed by student loans and missed payments. With SharkShop’s budgeting resources and expert advice, he learned how to manage his debts effectively. Within a year, he secured a low-interest car loan.

Lastly, we have Elena from New York who wanted to buy her first home but had a rocky credit history. Through SharkShop’s educational materials and support community, she gained insights into repairing her credit profile. She successfully qualified for a mortgage after just nine months on the platform.

These stories illustrate the transformative power of utilizing SharkShop for financial health management and credit score enhancement.

The Future of Financial Health: How SharkShop is Changing the Game

The landscape of financial health is evolving rapidly. SharkShop stands at the forefront, redefining how individuals manage their credit scores.

With innovative tools and user-friendly interfaces, SharkShop empowers users to take control of their finances like never before. Real-time insights on credit behaviors allow users to make informed decisions instantly.

Additionally, SharkShop cc personalized resources cater to individual needs. This level of customization fosters a deeper understanding of finance among its users.

As financial literacy becomes increasingly vital in today’s world, platforms like SharkShop are essential in bridging knowledge gaps. The focus shifts from mere score tracking to comprehensive education about maintaining good credit health.

This new approach not only enhances user experience but also builds confidence in navigating complex financial systems. With every update and feature release, SharkShop continues to change the game for better financial futures worldwide.

Conclusion: Why You Should Consider Using SharkShop for Your Credit Score Needs

When it comes to managing your financial health, having a solid credit score is essential. SharkShop.biz offers tools and resources that can help you track and improve your credit score effectively. With a user-friendly interface, personalized insights, and ongoing support, SharkShop stands out as an invaluable resource for anyone looking to enhance their financial standing.

Not only does the program demystify the complexities of credit scores, but it also empowers users with actionable steps they can take to boost their scores over time. The real-life success stories are testimony to its effectiveness—proof that many have transformed their financial futures by utilizing this platform.

As we navigate an increasingly complex financial landscape, services like SharkShop become more important than ever. If you’re ready to take charge of your credit health and explore new avenues for improvement, consider what SharkShop has to offer. It could be the key step toward achieving better financial stability today and in the future.

Leave a Reply