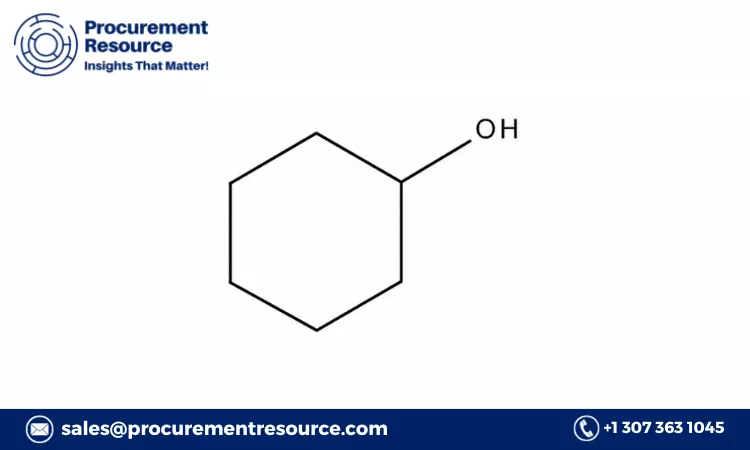

Cyclohexanol, a vital chemical intermediate used in the production of adipic acid, caprolactam, and other industrial chemicals, plays a significant role in numerous sectors such as textiles, automotive, and food production. Understanding the Cyclohexanol Price Trend is crucial for businesses relying on this chemical for manufacturing processes. This press release will explore the current Cyclohexanol Price Trend, provide an in-depth analysis of market movements, and offer insights into how price fluctuations impact industries globally.

Cyclohexanol Price Trend: An Overview

The Cyclohexanol Price Trend refers to the fluctuations in the price of cyclohexanol over time, which can vary significantly due to factors such as raw material costs, supply-demand dynamics, production processes, and market conditions. Cyclohexanol is primarily produced by the hydrogenation of phenol and is an essential precursor for the production of nylon 6, synthetic fibers, and plasticisers, making its price sensitive to demand shifts in these key industries.

Request a Free Sample – https://www.procurementresource.com/resource-center/cyclohexanol-price-trends/pricerequest

Over recent years, the Cyclohexanol Price Trend has been influenced by fluctuations in raw material costs, particularly the price of benzene (a key raw material in cyclohexanol production), as well as changes in global supply chain conditions. Energy costs, which are crucial for the hydrogenation process, also play a significant role in shaping pricing trends. In addition, geopolitical instability, natural disasters, and shifts in regional manufacturing capacity can lead to sudden price spikes or drops.

The trend of rising or falling prices often correlates with shifts in demand from major end-use industries, such as automotive (for synthetic rubber), textiles (for nylon production), and food processing (as a solvent). Understanding this trend is essential for manufacturers and consumers alike to make informed decisions on purchasing and inventory management.

Cyclohexanol Price Analysis

Cyclohexanol Price Analysis involves examining the factors that contribute to price fluctuations and understanding the underlying forces driving the market. The price of cyclohexanol is affected by several key drivers:

-

Raw Material Prices: Cyclohexanol production relies heavily on benzene as a primary raw material. Benzene prices, therefore, have a direct impact on the production cost of cyclohexanol. Fluctuations in the price of benzene—often driven by changes in crude oil prices—can lead to noticeable changes in cyclohexanol pricing.

-

Energy Costs: The production of cyclohexanol is energy-intensive, with hydrogenation processes requiring significant energy input. Therefore, rising energy costs, particularly in key production regions such as Asia, can contribute to higher cyclohexanol prices. Energy price volatility, whether driven by global oil prices or regional energy policy changes, is a key factor in understanding the Cyclohexanol Price Trend.

-

Supply Chain Disruptions: Cyclohexanol prices are also affected by supply chain disruptions. Natural disasters, geopolitical tensions, or even global pandemics can lead to interruptions in production or distribution networks, causing temporary price hikes. For example, supply chain issues in Asia, a major manufacturing hub, often cause ripple effects in global pricing.

-

Demand-Supply Imbalances: A surge in demand for cyclohexanol in industries such as automotive (for synthetic rubber) or textiles (for nylon production) can drive prices up. Conversely, reduced demand in these sectors due to economic slowdowns can lead to price decreases. The cyclical nature of some industries (e.g., automotive production) can lead to periods of high demand followed by quieter periods, contributing to price volatility.

-

Geopolitical and Regulatory Factors: Political instability, particularly in regions rich in raw materials (such as oil and natural gas), can affect the cost of production for cyclohexanol. Moreover, regulatory changes, especially in major manufacturing countries, can impact production costs, thus influencing the price trend.

By examining these factors, businesses can better predict potential price movements and adjust their procurement strategies accordingly. Continuous monitoring of market dynamics helps identify both short-term fluctuations and long-term trends.

Cyclohexanol Price Chart: Tracking Price Movements

A Cyclohexanol Price Chart provides a visual representation of how the price of cyclohexanol has moved over time. This chart is a valuable tool for industry analysts and businesses, as it highlights price trends, volatility, and major shifts in market conditions.

The chart typically tracks the historical prices of cyclohexanol over a period, which could range from weeks to months or even years. A Cyclohexanol Price Chart reveals:

-

Long-Term Price Trends: By examining a multi-year price chart, analysts can identify whether prices are generally rising or falling over time. For example, an upward trend may indicate consistent increases in demand for cyclohexanol, while a downward trend could signal decreased demand or lower production costs.

-

Seasonal Patterns: Some industries, like textiles or automotive, experience seasonal shifts in demand, which can be reflected in the Cyclohexanol Price Chart. Understanding these patterns allows businesses to make more informed purchasing decisions during peak or off-peak seasons.

-

Price Volatility: A Cyclohexanol Price Chart can highlight periods of extreme volatility, where prices spiked or dropped suddenly due to external factors, such as raw material shortages, natural disasters, or changes in regulatory policies.

-

Predictive Value: By analysing historical data and trends in the price chart, businesses can forecast potential price movements. For example, a strong upward trend may signal continued price increases, while a downward shift may present an opportunity to lock in prices before they fall further.

In short, a Cyclohexanol Price Chart provides an essential resource for market participants, offering clear insights into historical price movements and the factors behind them.

Cyclohexanol Price News: Key Updates Affecting the Market

Cyclohexanol Price News refers to the latest developments and updates that have the potential to affect cyclohexanol prices. This could include changes in raw material costs, shifts in supply and demand, regulatory changes, or geopolitical developments.

Key sources of Cyclohexanol Price News include:

-

Raw Material Updates: News about fluctuations in the price of benzene—such as changes in oil prices or shifts in crude oil production—can directly impact the price of cyclohexanol. Additionally, disruptions in the supply of raw materials due to geopolitical tensions or trade restrictions can drive up costs.

-

Market Demand Shifts: Industry reports on demand shifts in sectors like automotive and textiles, where cyclohexanol is used for synthetic rubber and nylon production, can provide important signals for price movements. A surge in demand from these sectors often leads to higher prices for cyclohexanol.

-

Supply Chain Disruptions: News related to natural disasters, factory shutdowns, or logistical disruptions can cause immediate price increases. Cyclohexanol producers may be unable to meet demand due to limited supply, leading to higher prices across markets.

-

Regulatory and Policy Changes: New environmental regulations or changes in manufacturing standards in key production countries (such as China, India, or the US) can impact the cost of production, leading to price adjustments. For example, stricter emissions standards for chemical plants could increase operational costs, influencing cyclohexanol prices.

By staying informed about Cyclohexanol Price News, businesses can anticipate potential price increases or decreases and adjust their purchasing and pricing strategies accordingly.

Cyclohexanol Price Index: Understanding Market Benchmarks

The Cyclohexanol Price Index is a benchmark used to track the average price of cyclohexanol in various markets around the world. This index is a critical tool for manufacturers, suppliers, and buyers who want to keep track of market trends and make informed purchasing decisions.

The Cyclohexanol Price Index is typically calculated by aggregating price data from different regions, factoring in production costs, raw material prices, and other relevant market conditions. This index provides a broad view of the market, helping businesses compare prices across regions and evaluate trends over time.

Key features of the Cyclohexanol Price Index include:

- Market Comparison: The index allows businesses to compare cyclohexanol prices across different regions, helping them identify the most cost-effective markets for procurement.

- Market Sentiment: A rising index suggests growing demand and higher production costs, while a falling index indicates lower demand or cost reductions. Businesses can use this information to adjust their inventory and pricing strategies.

- Forecasting Tool: By tracking the Cyclohexanol Price Index, businesses can gain insights into future price movements, helping them prepare for upcoming market conditions.

For large-scale buyers and suppliers, the Cyclohexanol Price Index is an essential tool to manage purchasing and pricing strategies effectively.

Cyclohexanol Price Graph: Visualising Market Movements

A Cyclohexanol Price Graph is a visual tool that represents cyclohexanol price movements over time. Unlike a price chart, which typically focuses on specific time intervals (daily, weekly, monthly), a price graph offers a broader, more long-term view, making it useful for identifying long-term trends and cycles.

Key features of a Cyclohexanol Price Graph include:

- Price Trends Over Time: The graph allows businesses to see how cyclohexanol prices have evolved over an extended period, providing a clear indication of upward or downward price movements.

- Impact of External Events: Major market events, such as supply chain disruptions or fluctuations in raw material prices, are often visible on a Cyclohexanol Price Graph, helping businesses correlate these events with price changes.

- Volatility Analysis: The graph helps businesses understand the volatility of cyclohexanol prices, which is crucial for risk management and forecasting future price movements.

By using a Cyclohexanol Price Graph, businesses can make informed decisions on when to purchase and what prices to expect in the future.

Contact Us

Company Name: Procurement Resource

Contact Person: Amanda Williams

Email: sales@procurementresource.com

Toll-Free Numbers:

USA copyright: 1 307 363 1045

UK: 44 7537171117

Asia-Pacific (APAC): 91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Leave a Reply